MiFID II is coming – is your organisation ready?

MiFID II has been described as “the most far-reaching legislation ever to impact the financial sector” and many firms, both in and outside of Europe, are bracing themselves for the far-reaching effects of this legislation.

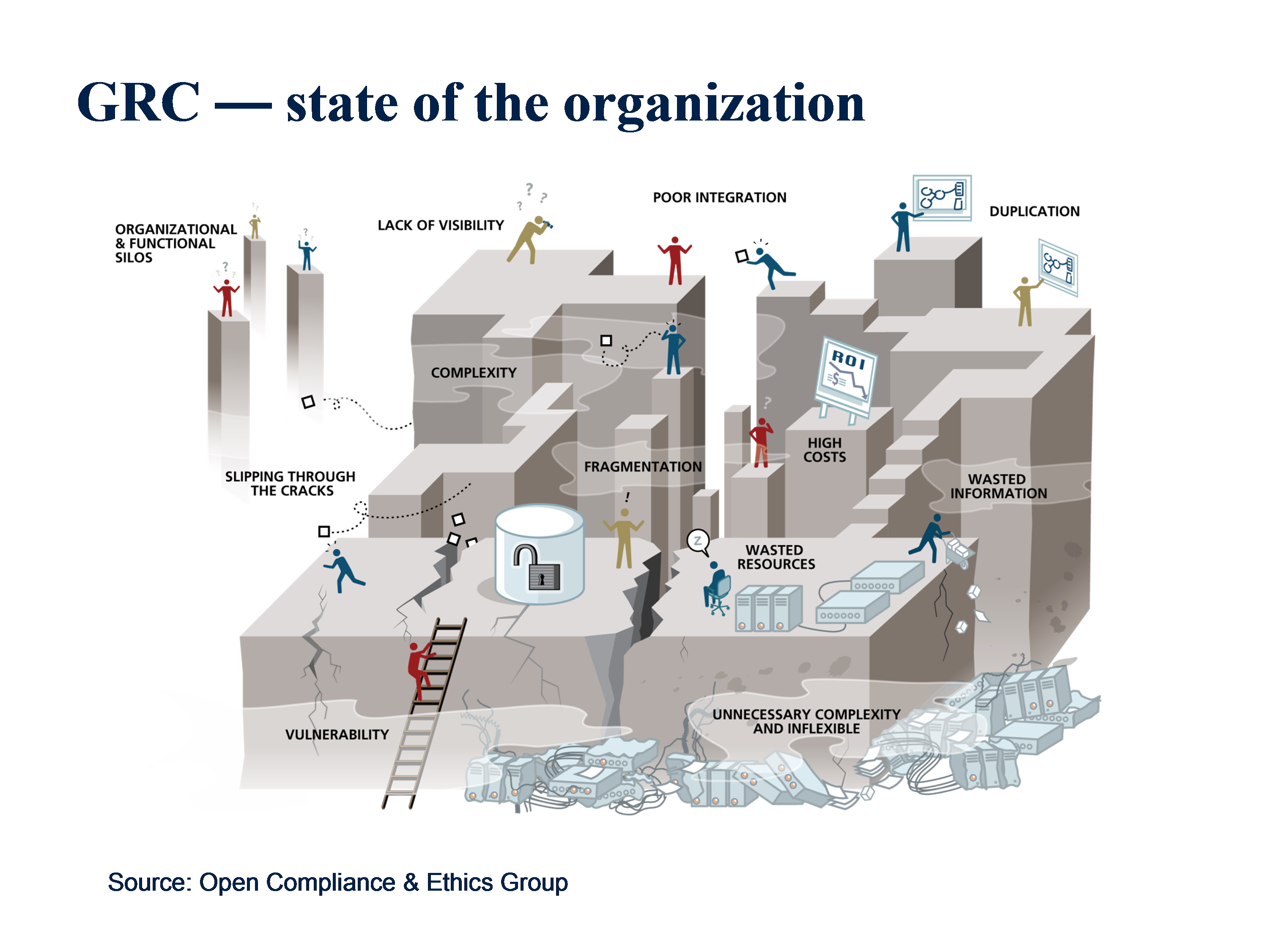

Although most firms have projects underway to address the changes, the vast majority still remain unprepared, with inadequate systems in place to provide full visibility and management of the data flowing through their organisations.

Big Data analytics, in particular the management and analysis of huge volumes of unstructured data (including text in various formats, trading records, audio records and video in numerous languages, dialects and accents) from countless sources, spanning multiple unconnected platforms, remains a significant challenge for most.

With global regulatory fines on banks set to surpass $200billion, the Finance industry must find ways to use Big Data in a “non-silo” fashion to remain compliant and competitive.

At Advanced Logic Analytics (ALA), we’ve created a number of market-leading technology solutions to help businesses consolidate their structured and unstructured data silos into a coherent whole, providing enhanced visibility for regulatory compliance as well as the ability to derive valuable business outcome insights and enable optimised decisions.

In addition, our Sentiment, Behavioural and Emotional Content analysis, using algorithms developed from over 10 years of academic research with a number of UK universities, also provides firms with predictive capabilities, to identify opportunities arising from market mispricing and future stock movements.

ALA are currently holding meetings with any organisations looking to address these issues. For more information or to arrange an appointment, please contact us on contact@advancedlogicanalytics.com