Using Award-winning ALASA Sentiment Analysis

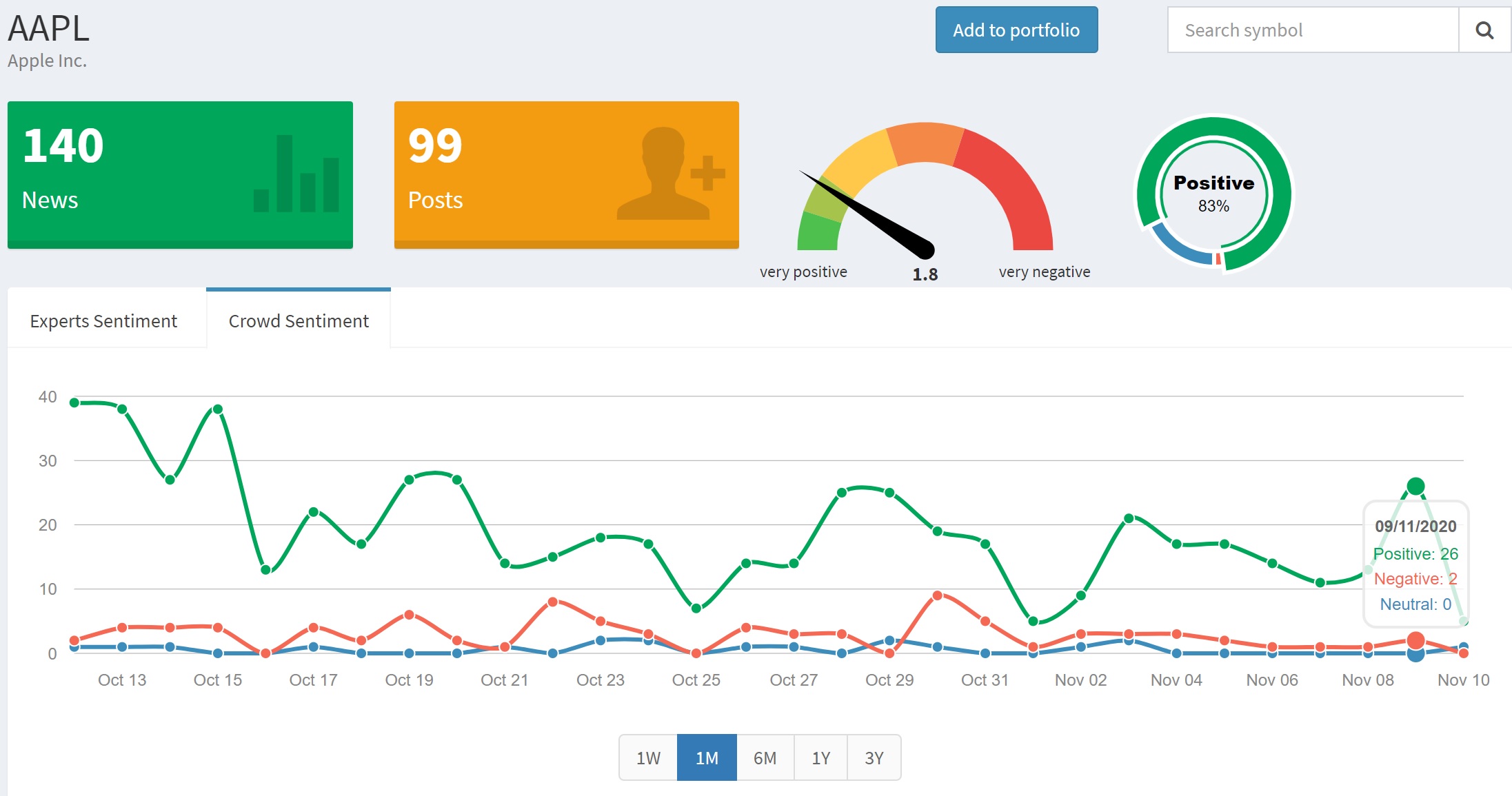

Used by quantitative traders and trading firms in live environments, ALASA helps both professional and retail investors make sense of human and market signals faster and more extensively than ever before. Here’s how.

ALASA uses advanced proprietary algorithms to gather information from both professional and crowd-based data sources globally. This data is then ordered and analysed, then an appropriate positive or negative sentiment weighting is applied. The output is a highly accurate sentiment-based feed which allows investors to track market news and mood across a variety of inputs.

Sentiment scores are driven by the aggregation of 6,500 news sources globally, and covers more than 420,000 tickers.

- Full desktop version.

- Additional instruments.

- API feed.

- Mobile app.

- Simple Top 10 worst and best S&P500 sentiment scores.

So, whether you’re a professional investor or a retail investor with a small portfolio there is a product for you. So, before you make another trade, you can either sign up today, or you can ask us to call you. Find out what the markets feel about your portfolio today.